INDUSTRY INSIGHTS:

On-farm TrendsAg Sector Increases Sustainability Practices even during Pandemici

The COVID-19 pandemic disrupted agriculture, food production, and food distribution worldwide. Globally, the sector experienced a reduced demand for restaurant and commercial food services, restrictions in labor, temporary closures of meat processing facilities, and supply chain disruptions.ii These impacts are in addition to other chronic environmental risks that the sector must manage – a decline in water and soil nutrients, loss of arable land, deforestation, and climate change.iii

Despite the challenges, the COVID-19 pandemic provides an opportunity to observe the investments and changes that the agricultural sector has made over the past year to further strengthen its resilience.

This Industry Insight report provides an overview of the agriculture sector’s sustainability performance using THESIS 2019 and 2020 dataiv shared by 386 companies across 187 food and beverage product categories, highlighting trends and improvements in a range of products across animal, fruit, vegetable, and specialty crop production. It focuses specifically on key performance indicators (KPIs) that require farm-level data given that most of the environmental and social hotspots for food products are within farm-level operations and collecting this data can be a challenge in complex food systems.

On-Farm Overview

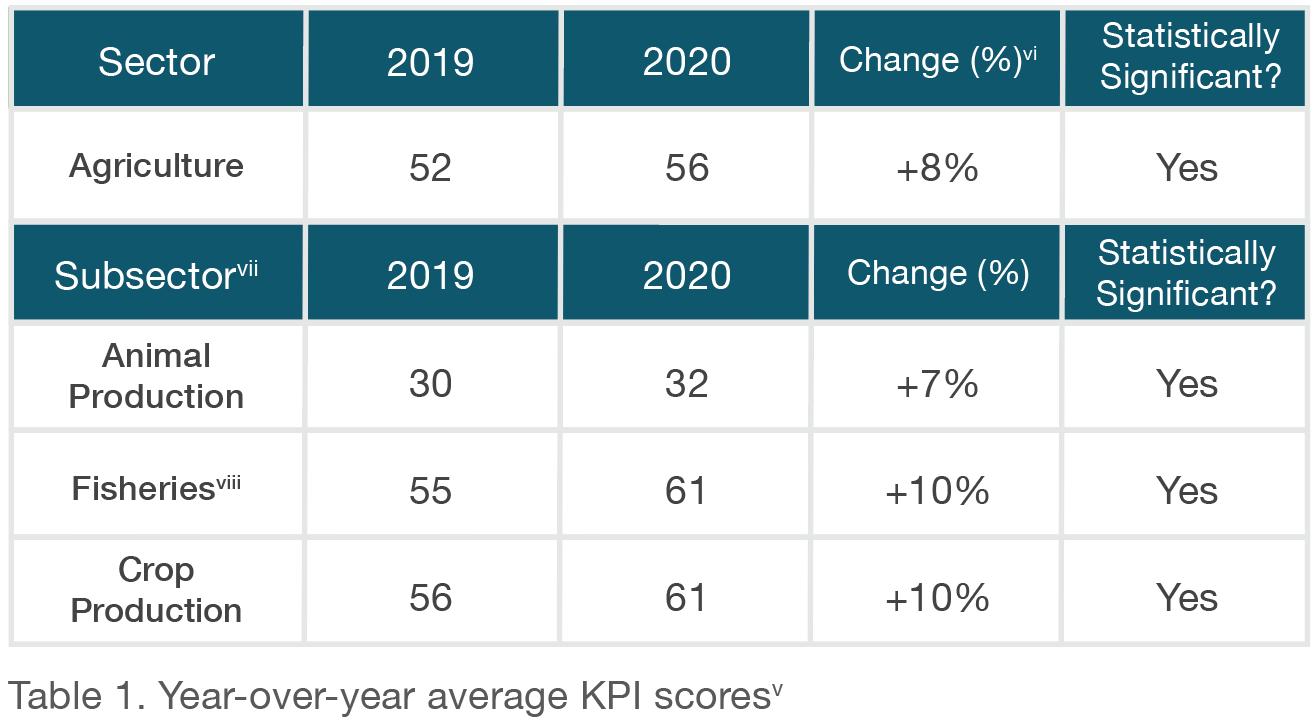

In response to the COVID-19 pandemic and related supply chain issues, most of the agriculture sector has shown resilience and appears to have increased its commitment to more sustainable practices. On a 100-point scale, with 0 being worst and 100 being best, average data scores related to farm-level practices rose significantly from 52 in 2019 to 56 in 2020 (Table 1).

Two subsectors stand out for their sustainability performance improvements: crop production and fisheries. In a year marked by the difficulties of a pandemic, crop and fisheries suppliers managed to increase their average KPI scores by 10% compared to 2019.

Fisheries

In fishing operations, certification and verification schemes that assure compliance with a sustainability standardix have contributed to improved environmental and social sustainability.x It is important to note, however, that certification programs are only part of a broader array of strategies that should be implemented to promote sustainable aquaculture and fisheries production.xi Despite the overall increase in performance, summary THESIS data indicates that some important social and environmental issues in fishing operations have worsened in 2020, including safe chemical use (23% decline), and forced and child labor (7% decline).

Crop Production

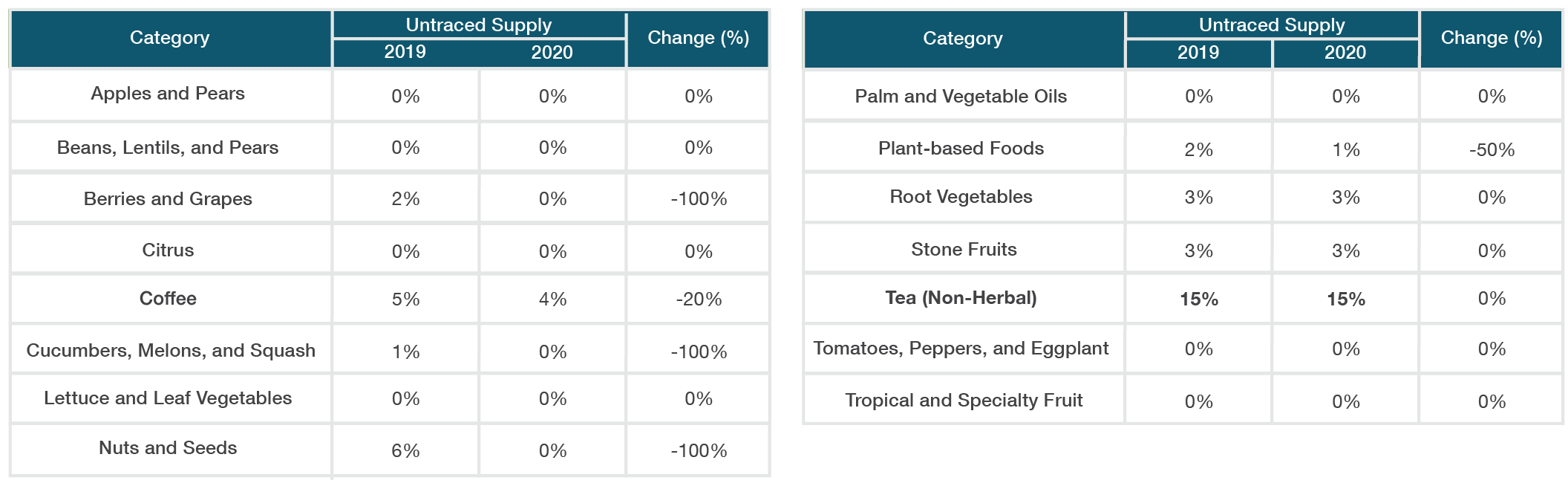

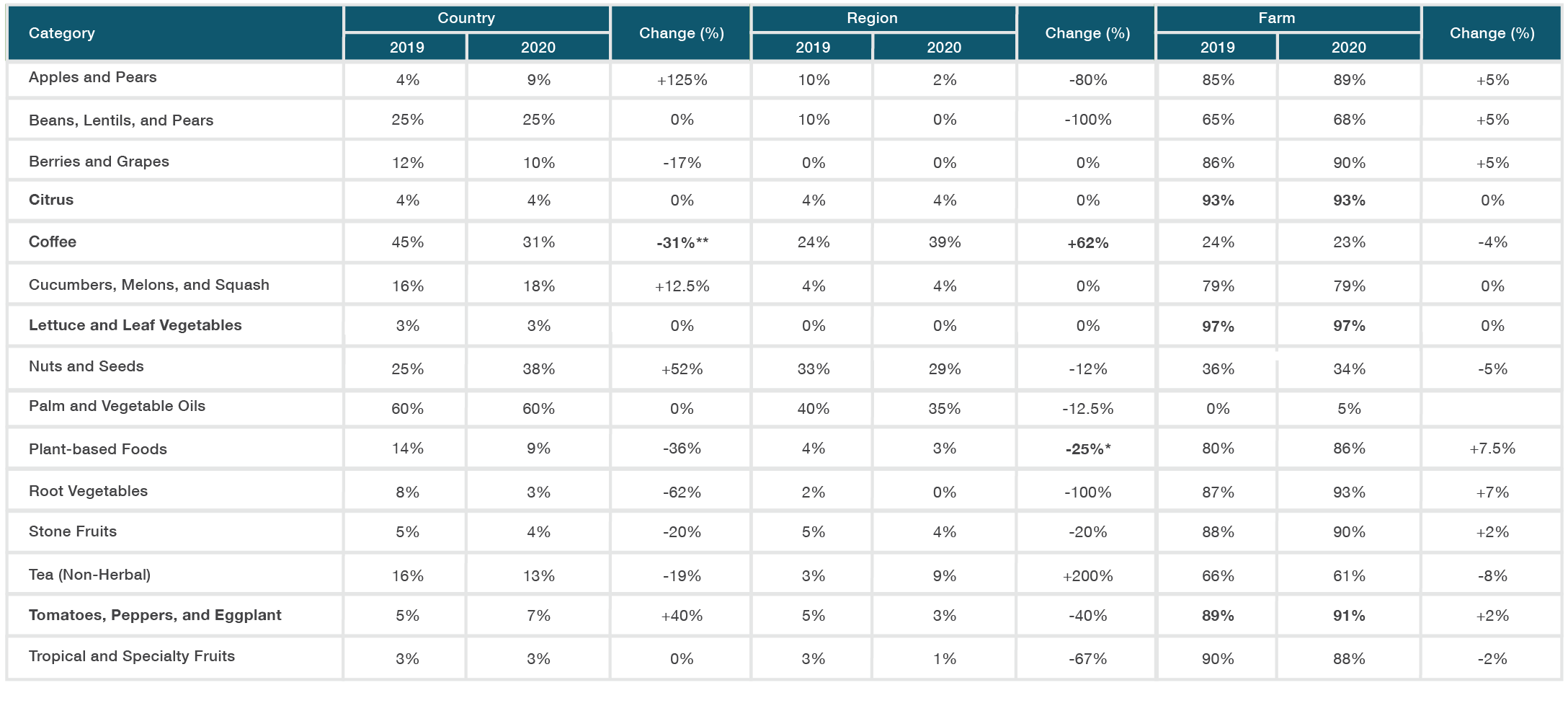

In the crop production subsector, which includes fruits, vegetables, beans, and grains, an increasing number of companies are mapping their supply chain to identify where and how their products were produced, which is a critical first step to improve the sustainability of their products. Average scores for the crop supply mapping KPI, which identifies the percentage of crop supply that was traced to the country, region, or farm of origin, have consistently been above 90%, except for the Tea (Non-Herbal) (76% in THESIS 2020) and Palm and Vegetable Oils categories (71% in THESIS 2020). Suppliers of Tea (Non-Herbal) who were able to determine a level of origin for at least part of their supply in 2019 and 2020 indicated that 15% of their tea supply was untraced (Table 2).

In contrast, suppliers of citrus, lettuce and leaf vegetables, and tomatoes, peppers, and eggplant were able to trace all their supply to at least one level of originxii in 2020 (Table 2), and over 90% of their supply, on average, was traced to the farm of origin, which is the highest level of specificity (Table 3). Suppliers in other product categories have also reduced the volume of their untraced supply and increased the volume of their supply traced to a higher level of specificity (country to region or region to farm).

Average scores in the Coffee category, for example, showed a statistically significant decrease in supply traced to the country of origin (31%) and a statistically significant increase in supply traced to the region of origin (62%) between 2019 and 2020, which means that coffee suppliers have been able to obtain more granular data about the origin of their supply.

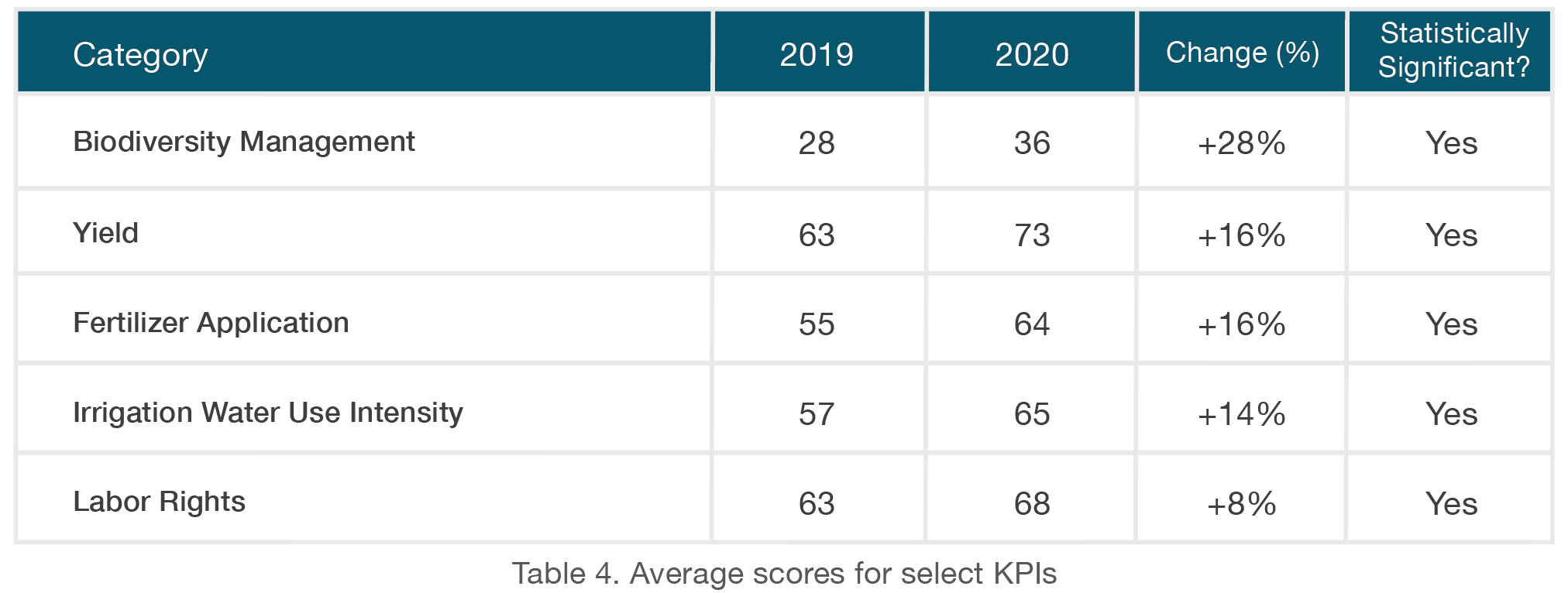

Improvements in the traceability of the crop production sector have resulted in increased transparency in on-farm activities related but not limited to the KPIs included in Table 4. These environmental KPIs are indicators associated with regenerative agriculture practices and indicate that collection and sharing of these data is increasing:

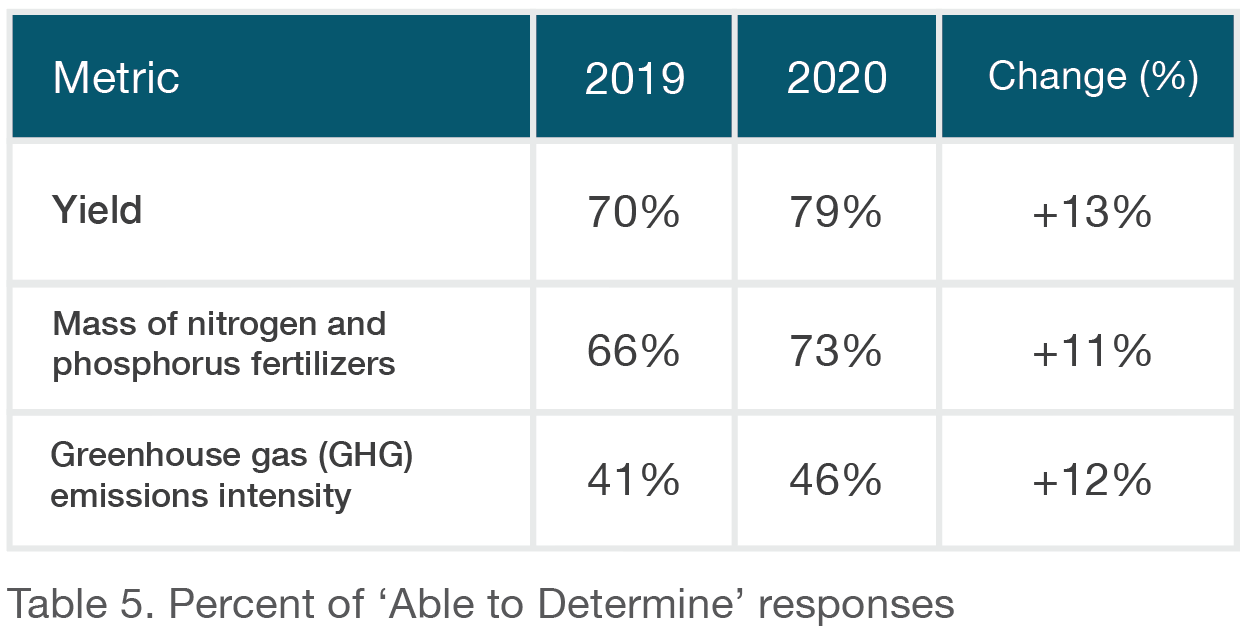

For example, THESIS 2020 results show that a higher number of suppliers were able to report metrics associated with regenerative agriculture practices including (Table 5):

-

Mass of nitrogen and phosphorus fertilizers used to produce their crop supply,

-

Average yield of their crop supply, and

-

The greenhouse gas (GHG) emissions intensity associated with the energy and fuel use at the growing operations that produced their crop supply.

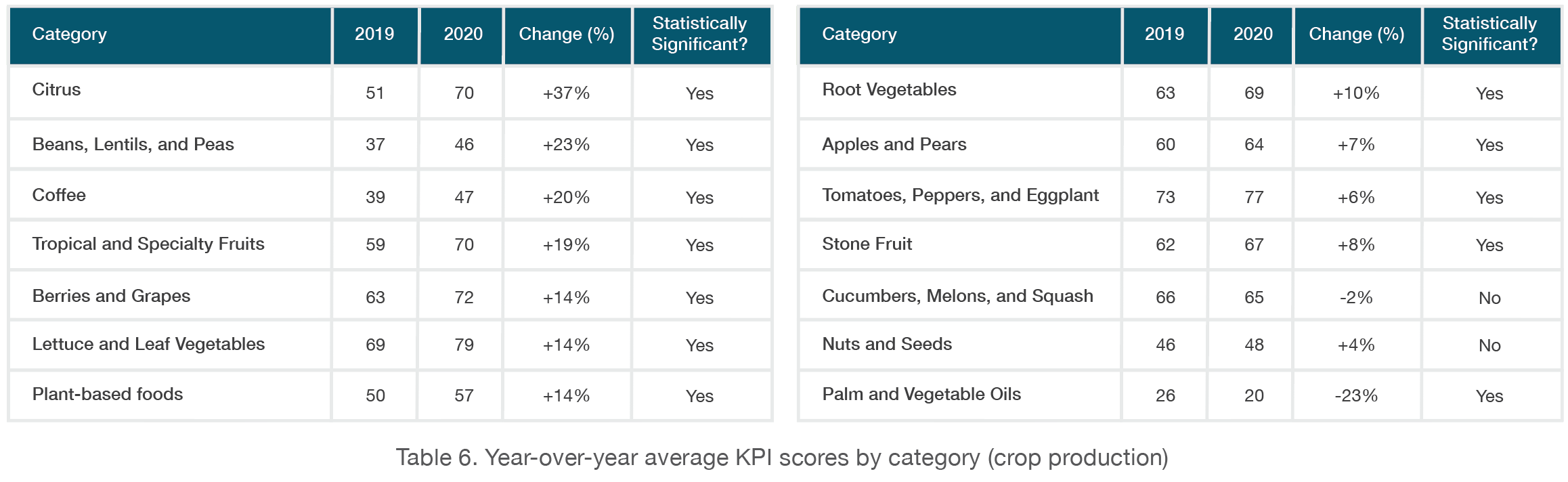

Another trend that emerges from THESIS product category data is that, in general, suppliers with relatively lower scores in 2019 had the highest percentage increase in 2020.

For instance, the Beans, Lentils, and Peas category, which had one of the lowest scores in the subsector in 2019, saw an increase of 23% in 2020. Coffee had a relatively low score in 2019 and had an increase of 20% in its category average score in 2020.

In contrast, the Tomatoes, Peppers, and Eggplant category, which had the highest score for the crop production subsector in 2019, had a relatively small increase of 6% in 2020.

An exception to the overall increase in scores in the crop production subsector was the Palm and Vegetable Oils category. Analysis of the 2019-2020 THESIS data reveals that the category had a decrease of 23% in its already relatively low average score. The Palm Oil category had a performance decline in crucial areas, including deforestation and land conversion, and indigenous peoples’ and community rights. This is particularly concerning given that palm oil has been a major driver of deforestation in some parts of the worldxiii and, in many instances, its production has been accompanied by local land conflicts related to indigenous land rights.xiv As the global demand for palm oil plummeted across the world due to the COVID-19 pandemic, there is indication that efforts to make the palm oil sector more sustainable have suffered a setback.xv

Animal Production

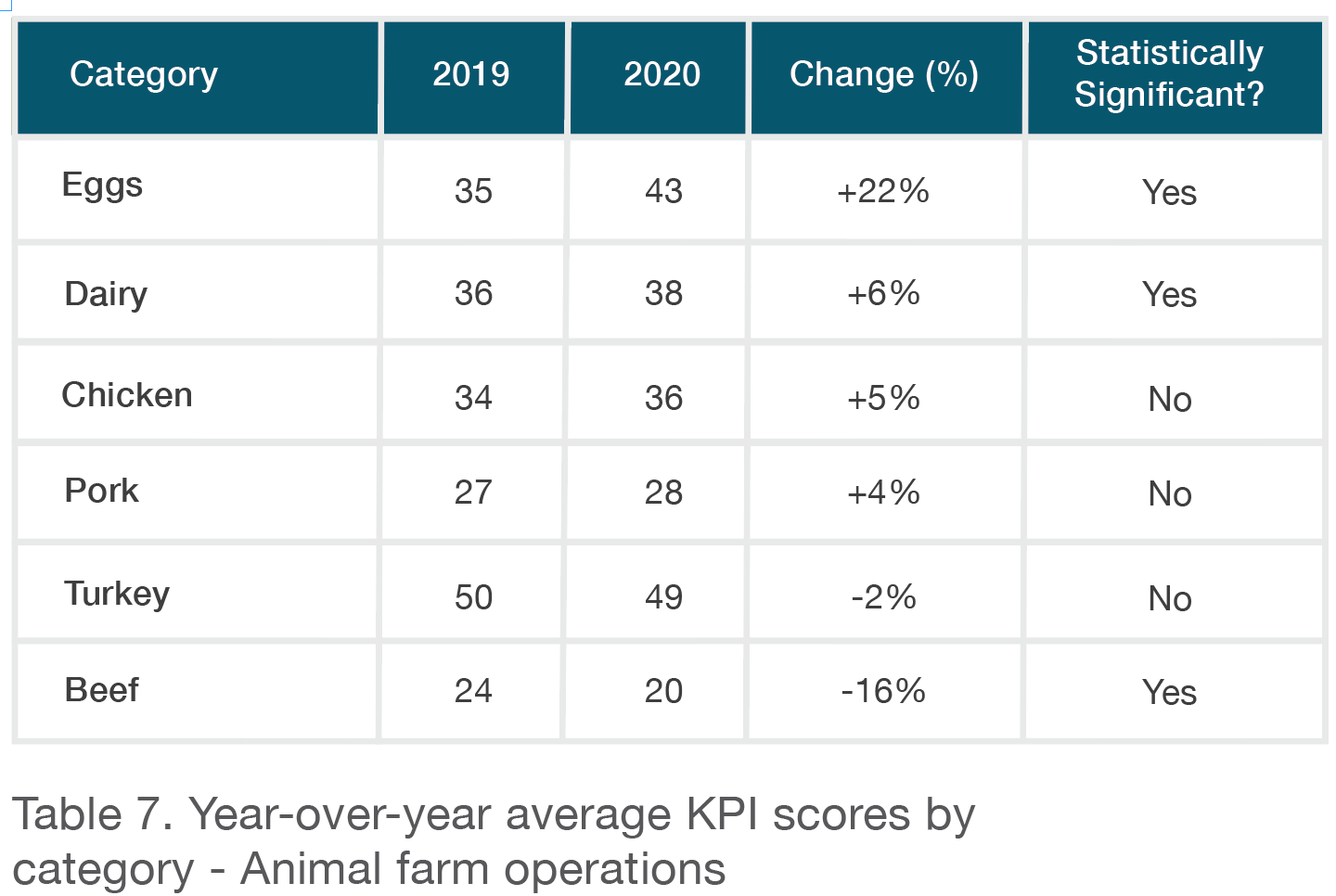

In the animal production subsector, livestock production was among the most impacted industries by the COVID-19 pandemic.xvi Analysis of THESIS data indicates that the Beef category had the poorest performance in 2020, with a reduction of 16% in its already low average score (Table 7).

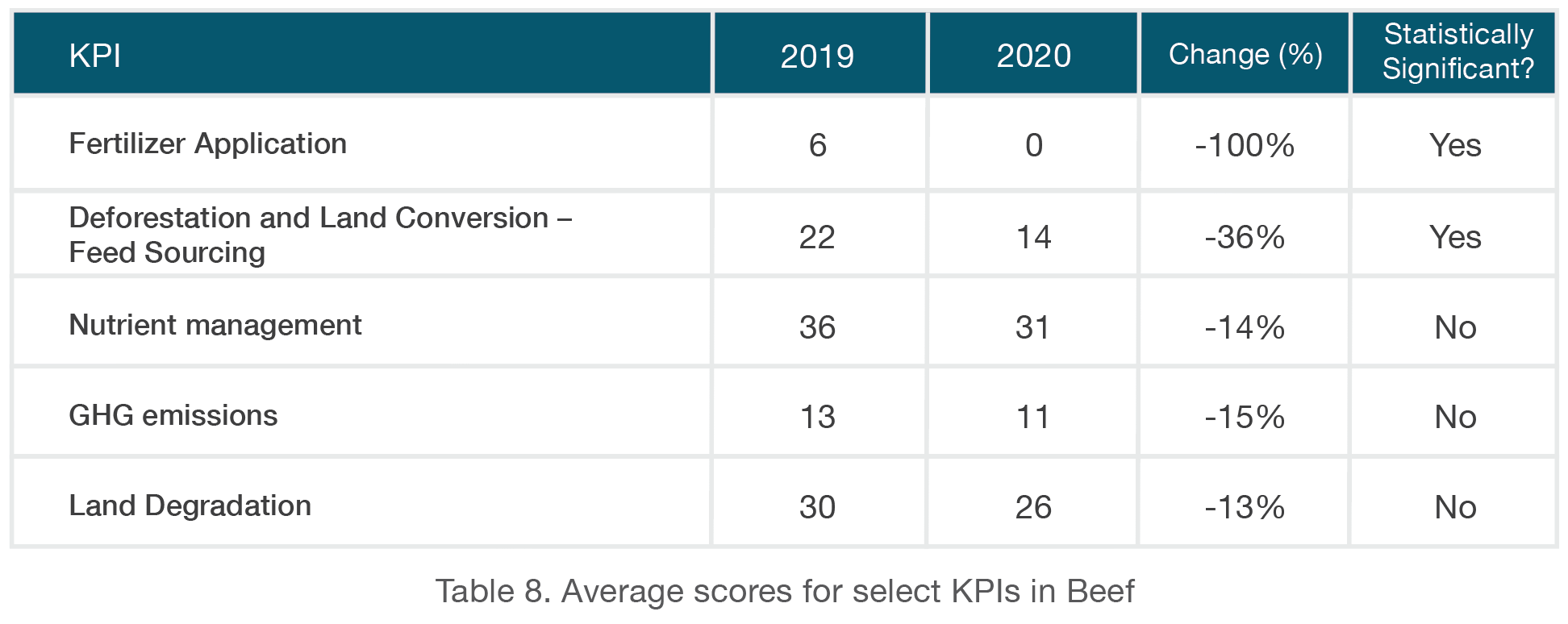

In addition to palm oil, the production of beef and soy are the main drivers of deforestation in the world. Studies have suggested that beef alone was responsible for 2.1 million hectares of global deforestation per year in the from 2005 to 2013 (41% of total global deforestation).xvii 2020 THESIS data indicates that the Beef category had a 55% decline in scores related to the Deforestation and Land Conversion – Finishing Stage KPI, compared to 2019. Other hotspots in the Beef category that saw a decline in performance are outlined in Table 8

On the other hand, the Eggs category had the highest increase in performance in the animal production subsector. Improvements were achieved through transparency and traceability, resulting in higher scores in several on-farm KPIs related to feed conversion ratio, GHG emissions, and water use. This underscores the importance of working to improve supply chain transparency and traceability. The lack of visibility into farm-level management practices for agricultural inputs has presented a major challenge for efforts to increase supply chain sustainability.xviii

The impact of the COVID-19 pandemic has had far reaching implications across the agriculture and food supply chain. Key findings emerged from this Industry Insight report focused on farm-level key performance indicators:

Transparency and Traceability: Considering that most of the environmental and social impacts of food products are within farm-level operations, transparency and traceability are essential to demonstrate accountability. In addition, demand from the financial sector and consumers will increase in the coming decade for transparency into on-farm production practices.xix It is imperative for food companies to take steps to map their supply chain to identify where and how their products were produced.

Commodity Supply Chains: Forest-risk commodity supply chains, such as palm oil and beef, continue to indicate poor sustainability performance.

Palm and Vegetable Oil: In the crop production subsector, palm and vegetable oils had the poorest sustainability performance and has struggled to maintain its score year-over-year. The category had a performance decline in key areas, including deforestation and land conversion and indigenous peoples’ and community rights. This is particularly concerning given that conflict palm oil is currently found in roughly half of all packaged products sold in U.S. grocery stores, and major companies have been implicated in indirectly sourcing palm oil from illegal operations engaged in deforestation and human rights violations in recent years.xx Companies buying palm oil have the responsibility to take steps to ensure that their supply chain is sustainable and free from deforestation and labor rights violations

Beef: Across the animal production subsector, beef had the worst sustainability performance. The category had a performance decline in important areas such as deforestation, fertilizer application, and land degradation. THESIS results are reported from global supply chains not just US origination. Despite hundreds of major companies and brands committing to source only sustainable beef, the beef sector is still driving deforestation, biodiversity crisis, and indigenous rights violations.xxi Changes must be implemented in the sector, and companies must step up to ensure only buying from suppliers who are producing beef in a sustainable way.

The financial sector is increasingly recognizing the risks associated with climate change and environmental and social issues as it is shifting financial flows away from unsustainable activities. In addition, consumer interest in sustainable products is growing despite or even because of the COVID-19 pandemic.xxii A rising number of consumers are concerned about the environmental and social impacts of the products they buy and are demanding action. Suppliers and retailers can answer this call to action by improving and transforming their supply chain to offer more sustainable products. THESIS helps track these actions and helps companies determine how they are performing related to their peers and industry for continuous improvement. Only through transparency can a company demonstrate their progress towards sustainable production and utilizing THESIS is a way to demonstrate improvement and leadership in the marketplace.xxiii

References

[i] The analysis of the farm sector for this Industry Insight included establishments primarily engaged in growing crops, raising animas, or harvesting fish and other animals from a farm, ranch, or their natural habitats.

[ii] Stephens, E. C., Martin, G., van Wijk, M., Timsina, J., & Snow, V. (2020). Impacts of COVID-19 on agricultural and food systems worldwide and on progress to the sustainable development goals. Agricultural Systems, 183, 102873.

[iii] The Sustainability Consortium (TSC). How The Sustainability Consortium creates THESIS Key Performance Indicator Set. https://www.sustainabilityconsortium.org/wp-content/uploads/2020/06/THESIS-Methodology-Brief-31-MAR-2020.pdf

[iv] With a few exceptions, THESIS data guidelines permit users to assess the sustainability impact of their practices for a rolling two year timeframe. Therefore, some THESIS 2020 insights may reflect activities pre-Covid 19.

[v] Numbers were rounded to the nearest integer (up or down).

[vi] All changes are expressed as percent increase (not percentage point increase).

[vii] The classification of subsectors was based on the North American Industry Classification System (NAICS).

[viii] The aquaculture sector also performed well overall but was excluded from this Industry Insight due to the small number of suppliers in that category.

[ix] Kuit, M., & Waarts, Y. (2014). Small-scale farmers, certification schemes and private standards: Is there a business case?. CTA.

[x] Boyd, C. E., D’Abramo, L. R., Glencross, B. D., Huyben, D. C., Juarez, L. M., Lockwood, G. S., … & Valenti, W. C. (2020). Achieving sustainable aquaculture: Historical and current perspectives and future needs and challenges. Journal of the World Aquaculture Society, 51(3), 578-633.

[xi] Bush, S. R., Belton, B., Hall, D., Vandergeest, P., Murray, F. J., Ponte, S., … & Kusumawati, R. (2013). Certify sustainable aquaculture?. Science, 341(6150), 1067-1068.

[xii] For the purpose of the Crop Supply Mapping KPI, country of origin is the lowest level of specificity and farm of origin is the highest level of specificity.

[xiii] World Wide Fund for Nature (WWF). (January 17, 2020). 8 things to know about palm oil. Accessed July 2021, https://www.wwf.org.uk/updates/8-things-know-about-palm-oil

[xiv] Nesadurai, H. E. (2017). Food security, the palm oil–land conflict nexus, and sustainability: a governance role for a private multi-stakeholder regime like the RSPO?. In East Asia and Food (In) Security (pp. 85-110). Routledge.

[xv] Business & Human Rights Resource Centre. (April 14, 2020). Impacts of coronavirus epidemic on efforts to expand sustainable palm oil market yet to be evaluated, experts suggest. https://www.business-humanrights.org/en/latest-news/impacts-of-coronavirus-epidemic-on-efforts-to-expand-sustainable-palm-oil-market-yet-to-be-evaluated-experts-suggest/

[xvi] Marchant-Forde, J. N., & Boyle, L. A. (2020). COVID-19 effects on livestock production: A One Welfare issue. Frontiers in veterinary science, 7, 734.

[xvii] Hannah Ritchie and Max Roser (2021) – “Forests and Deforestation”. Published online at OurWorldInData.org. Retrieved from: https://ourworldindata.org/forests-and-deforestation.

[xviii] The Sustainability Consortium (TSC). (2019). Data Landscape Mapping in Agricultural Supply Chains. https://www.sustainabilityconsortium.org/tsc-downloads/data-landscape-mapping-in-agricultural-supply-chains-projectreport/?ind=1549904142312&filename=Data%20Landscape%20Report_Final.pdf&wpdmdl=28646&refresh=60de46b25740e1625179826

[xix] Slattery, D., Rayburn, K., Slay, C.M., Garcia-Moore, T. (2021). Farmer Perspectives on Data 2021. https://www.trustinfood.com/wp-content/uploads/2021/05/Farmer-Perspectives-on-Data-2021.pdf

[xx] Rainforest Action Network. THE HUMAN COST of CONFLICT PALM OIL – Indofood: PEPSICO’S HIDDEN LINK TO WORKER EXPLOITATION IN INDONESIA. https://www.ran.org/wp-content/uploads/rainforestactionnetwork/pages/15889/attachments/original/1467043668/The_Human_Cost_of_Conflict_Palm_Oil_RAN.pdf?1467043668

[xxi] WWF. What must companies do? https://palmoilscorecard.panda.org/recommendations

[xxii] New York University (NYU). (July 16, 2020). Sustainable Market Share Index – Research on 2015-2020 IRI Purchasing Data Reveals Sustainability Drives Growth, Survives the Pandemic. https://www.stern.nyu.edu/sites/default/files/assets/documents/2020%20Sustainable%20Market%20Share%20Index.pdf

The Sustainability Consortium (TSC) is a global non-profit organization working to transform the consumer goods industry by partnering with leading companies to define, develop, and deliver sustainable products. The Sustainability Insight System, or THESIS, is the independent, science-based, holistic sustainability performance solution created by TSC that allows brands and manufacturers to understand the sustainability story of their products. In 2019, THESIS was used by over 1500 companies covering products representing over a trillion (U.S.) dollars in annual sales.

THESIS INDUSTRY INSIGHTS ARE A UNIQUE SOURCE FOR HOLISTIC DATA AND ANALYSES ABOUT THE CURRENT STATE OF PRODUCT SUSTAINABILITY.